- 3.11.2021

- 464 views

0

0

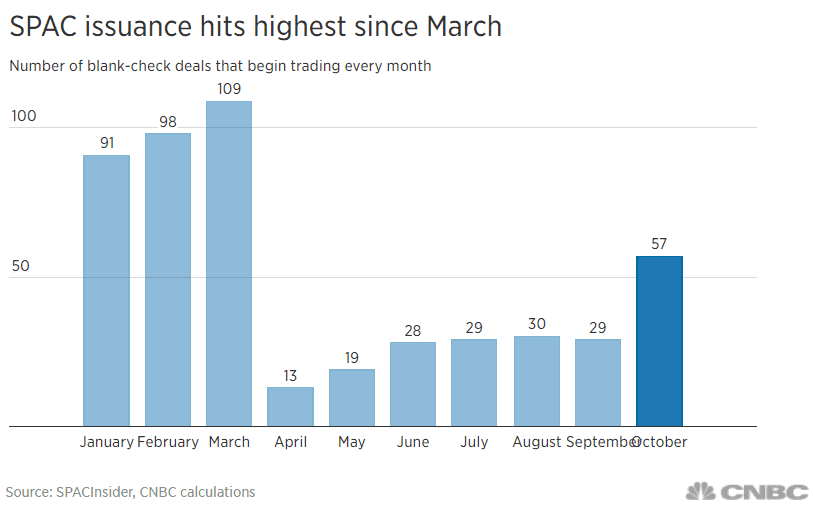

SPAC issuance jumps to the highest since March as deals rush to market before year-end

A total of 57 SPACs began trading in October, the highest amount since March when a record of 109 SPACs were issued.

The number of new blank-check deals last month nearly doubled that in September.

The rebound came as a backlog of blank-check deals held up by accounting and other regulatory issues rushed to the market before the year ends.

The SPAC market could be staging a comeback with issuance hitting an eight-month high as the industry continues to ride out regulatory challenges.

A total of 57 special purpose acquisition companies began trading in October, the highest amount since March when a record of 109 SPACs were issued, according to SPACInsider and CNBC calculations. The number of new deals in October nearly doubled that in September and was also higher than the total during the same time last year, the data showed.

The rebound came as a backlog of blank-check deals held up by accounting and other regulatory issues rushed to the market before the year ends. The Securities and Exchange Commission in April issued new accounting guidance on SPAC warrants that required sponsors to restate their financial documents, which led to a significant slowdown in issuance.

“That was a hiccup, but once the rules of the road were established, that was taken care of pretty quickly by accounting firms and law firms,” said Perrie Weiner, partner at Baker McKenzie LLP.

SEC Chairman Gary Gensler has repeatedly warned of the misaligned interests between sponsors and shareholders and said greater disclosure is needed. Gensler said in June that the agency planned to propose rule changes.

“The SEC’s focus is on transparency, on conflicts of interest and on concerns of share dilution,” Weiner said. “I think that once the SEC gets comfortable and investors are going in eyes open, it will become just like any other widely accepted financing structure. It’s definitely here to stay.”

While SPAC issuance has bounced back, stock performance hasn’t. The proprietary CNBC SPAC 50 index, which tracks the 50 largest U.S.-based pre-merger blank-check deals by market cap, is still down about 3% on the year.

Meanwhile, SPAC redemptions have been climbing amid waning investor appetite. The average SPAC redemption ratio — the percentage of shares that investors redeem prior to closing of an acquisition — has risen in the last two quarters, after falling to all-time lows in the first quarter, according to Barclays.

— CNBC’s Gina Francolla contributed reporting.

You must be logged in to post a comment.

There are no reviews.